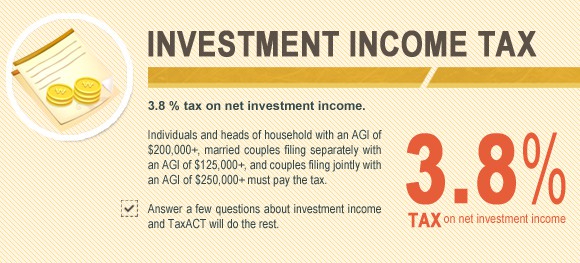

The Net Investment Income Tax (NIIT) is a unique tax provision, introduced in 2013 to help pay for the Affordable Care Act (ACA). While the NIIT may be the focus of future congressional action, the ...

0 Comments Click here to read/write comments

Most tax-deductible expenses fall into a specific category. For instance, you can usually claim mortgage interest and charitable contributions as itemized deductions on Schedule A of your Form 1040. ...

0 Comments Click here to read/write comments

Although you can't deduct the value of time and energy spent on charitable endeavors, you can often write off unreimbursed expenses incurred while performing charitable duties. Here are some of the ...

0 Comments Click here to read/write comments

Are you facing a tax liability on your 2016 return or looking for a bigger tax refund? There's little you can do now to reduce the tax, but there's at least a couple options that may be available to ...

0 Comments Click here to read/write comments