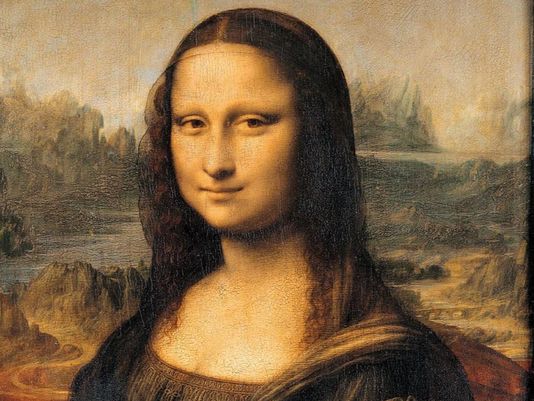

Do you own a prized piece of art that you'd like to donate to charity? If you meet the requirements for gifts of property, you may qualify for an enhanced tax deduction which could be a beautiful ...

0 Comments Click here to read/write comments

Suppose you just glanced at the 2016 tax return you filed in April and noticed an error or omission. Or maybe you remembered a deduction you neglected to include on your return from the prior year. ...

0 Comments Click here to read/write comments

Do you work from your own home? If so, you may be entitled to deduct home office expenses on your personal income tax return. Taxpayers are sometimes hesitant to use this deduction, but the IRS ...

0 Comments Click here to read/write comments

After years of uncertainty, the Protecting Americans from Tax Hikes (PATH) Act of 2015 permanently extended a tax credit for research expenses for qualified small businesses. Generally speaking, the ...

0 Comments Click here to read/write comments