Do you often work from the comfort of your own home? Depending on your circumstances, you may qualify for a home office deduction that can reduce your tax liability....

Richard Ong

Recent Posts

Suppose you're planning to take a business trip across the country. Are you eligible for tax benefits if you invite your spouse to accompany you? It depends on your circumstances. Specifically, the ...

Suppose you're buying a home and searching for a mortgage. There are a myriad of choices in today's marketplace with interest rates at near-record lows. In some cases, you may qualify for a ...

The rules that define real estate activities for tax purposes can be confusing. Is the real estate business you conduct considered passive activity or could you be defined as a real estate ...

The dependent care credit may be changed by Congress in the coming years, but you can still take advantage of it now. It offers some surprising benefits that may apply to your situation....

If you have a child graduating from college this year, money can be tight as he or she embarks on a career. So it's often hard to convince your child to set aside money for a retirement date that may ...

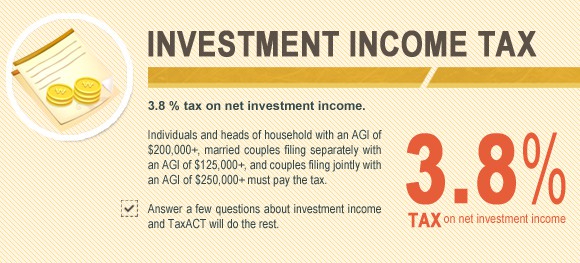

The Net Investment Income Tax (NIIT) is a unique tax provision, introduced in 2013 to help pay for the Affordable Care Act (ACA). While the NIIT may be the focus of future congressional action, the ...

Most tax-deductible expenses fall into a specific category. For instance, you can usually claim mortgage interest and charitable contributions as itemized deductions on Schedule A of your Form 1040. ...

Although you can't deduct the value of time and energy spent on charitable endeavors, you can often write off unreimbursed expenses incurred while performing charitable duties. Here are some of the ...