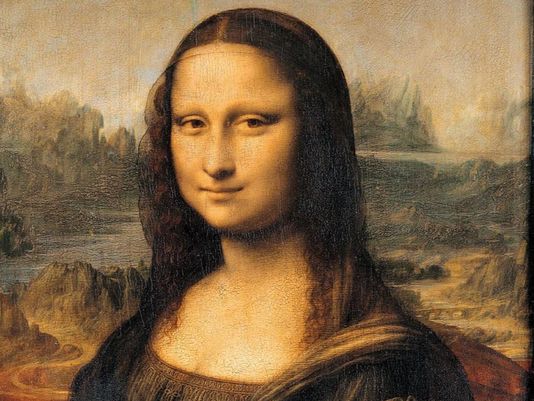

Do you own a prized piece of art that you'd like to donate to charity? If you meet the requirements for gifts of property, you may qualify for an enhanced tax deduction which could be a beautiful ...

Suppose you just glanced at the 2016 tax return you filed in April and noticed an error or omission. Or maybe you remembered a deduction you neglected to include on your return from the prior year. ...

Do you work from your own home? If so, you may be entitled to deduct home office expenses on your personal income tax return. Taxpayers are sometimes hesitant to use this deduction, but the IRS ...

After years of uncertainty, the Protecting Americans from Tax Hikes (PATH) Act of 2015 permanently extended a tax credit for research expenses for qualified small businesses. Generally speaking, the ...

After paying taxes on earnings during your entire work career, you may finally be entitled to receive Social Security retirement benefits. But be aware that those benefits could come at a tax price. ...

Local bridal boutique owner and designer, Emily Brown, of Emily Hart Bridal is giving back to those in need through her Hart for Humanity campaign while continuing to create memorable experiences for ...

Now that summer has arrived, you may find opportunities to combine business activities with pleasure, which could result in tax breaks. Here are five of those potential breaks....

Is your teenager looking for a job for the summer? Hiring him or her to work in your business not only provides a little income for your child, but it can result in several tax and financial benefits....

Governor Sam Brownback's grand experiment with his "March to Zero" tax plan came to a crashing (and retroactive) halt this week when both chambers of the legislature voted to override his veto of a ...

.jpg)