Now that 2018 models are in the showrooms, you may be shopping for a new car to purchase for your business. Be aware that if you are self-employed, you can use one of two methods; the actual expense ...

August is the middle of hurricane season for the eastern and southern coasts. Other regions of the U.S. experience tornados, floods, and wildfires. If you're victimized by a natural disaster this ...

Gambling may not be for everyone but many people occasionally place wagers at the track or indulge in games of chance. You may be one of them. If you're lucky enough to hit a jackpot, or even if you ...

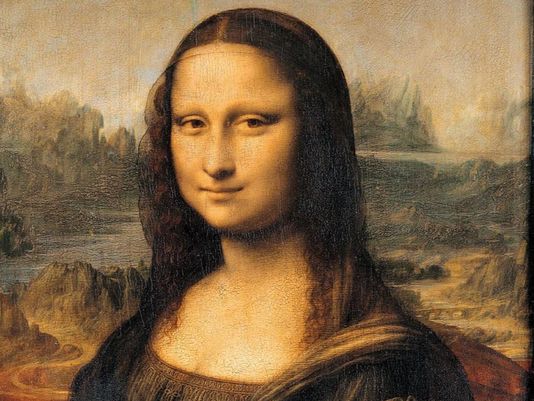

Do you own a prized piece of art that you'd like to donate to charity? If you meet the requirements for gifts of property, you may qualify for an enhanced tax deduction which could be a beautiful ...

Do you work from your own home? If so, you may be entitled to deduct home office expenses on your personal income tax return. Taxpayers are sometimes hesitant to use this deduction, but the IRS ...

Now that summer has arrived, you may find opportunities to combine business activities with pleasure, which could result in tax breaks. Here are five of those potential breaks....

Is your teenager looking for a job for the summer? Hiring him or her to work in your business not only provides a little income for your child, but it can result in several tax and financial benefits....

Usually if you sell securities and the transaction results in a loss, you can use the loss to offset capital gains, plus up to $3,000 of ordinary annual income. Any excess loss over that amount is ...

Do you often work from the comfort of your own home? Depending on your circumstances, you may qualify for a home office deduction that can reduce your tax liability....

Suppose you're planning to take a business trip across the country. Are you eligible for tax benefits if you invite your spouse to accompany you? It depends on your circumstances. Specifically, the ...