Tick, tick, tick … the deadline for filing your 2017 tax return is rapidly approaching. The traditional due date is April 15, but you technically have until April 17 to file your 2017 return. Why? ...

The Tax Cuts and Jobs Act (TCJA) does much more for businesses than lower corporate tax rates. With careful planning, your small business may realize big tax benefits under the new law. Here are ...

Under the tax reform plan recently announced by the Trump administration, most itemized deductions would be eliminated, except those for charitable donations and mortgage interest....

Some tax planning moves for small businesses are more common, like acquiring property that qualifies for the generous Section 179 expensing allowance. But other strategies may fly under the radar. ...

Are you upgrading the offices or workspace of your small business? This may be an opportunity to make improvements to accommodate individuals with disabilities (including your own employees and ...

A couple can claim the Child and Dependent Care Credit — commonly called the "child care credit" for short — if they pay someone to watch the kids while they're at work. But suppose one spouse plans ...

In today's tax environment, nothing is certain. However, as things stand now, high-income taxpayers may continue to value municipal bonds ("munis") and muni bond funds. Just consider these four tax ...

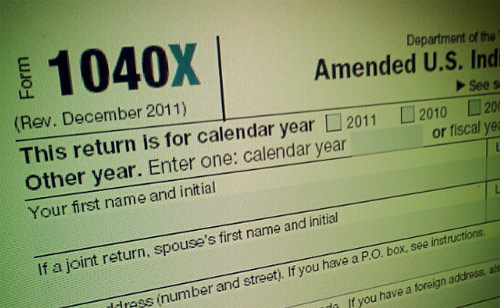

Suppose you just glanced at the 2016 tax return you filed in April and noticed an error or omission. Or maybe you remembered a deduction you neglected to include on your return from the prior year. ...

After years of uncertainty, the Protecting Americans from Tax Hikes (PATH) Act of 2015 permanently extended a tax credit for research expenses for qualified small businesses. Generally speaking, the ...

After paying taxes on earnings during your entire work career, you may finally be entitled to receive Social Security retirement benefits. But be aware that those benefits could come at a tax price. ...