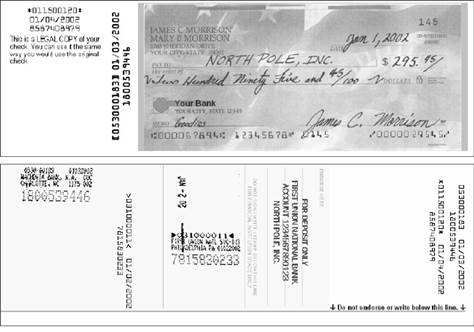

IRS Proof of Payment Requirements

Self Employment, Tax Planning, Tax Representation, Tax Deductions

Five Year End Tax Reminders

Retirement Savings, Tax Planning, Education Tax Benefits, Tax Deductions

Here are five tax saving ideas that can be used by most taxpayers. But act soon, there's not much time left until our tax year comes to an end....