On April 24, 2020, President Trump signed the Paycheck Protection Program (PPP) and Health Care Enhancement Act into law. The act provides $320 billion in supplemental funding for the PPP and ...

Our team has been working hard to stay up to date on the planning opportunities under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which was signed into law on March 27, 2020. If ...

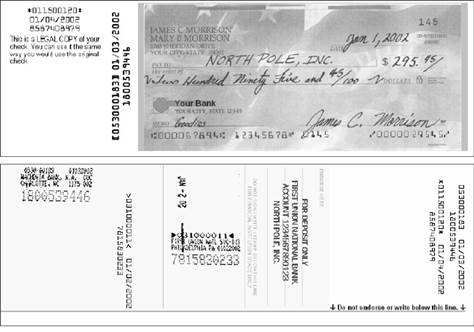

IRS Proof of Payment Requirements

Self Employment, Tax Planning, Tax Representation, Tax Deductions

Cash in on summertime tax savings Summer is usually the time for relaxing, but it can also be a time for tax savings, especially if you're still reeling from an unexpectedly large tax bill in April. ...

Second Quarter Estimated Taxes Due If you have not already done so, now is the time to review your tax situation and make an estimated quarterly tax payment using Form 1040-ES. The second quarter due ...

Are you involved in the gig economy — or the labor market made up of freelance and other temporary work — that's gaining popularity? This type of sharing economy involves individuals and groups who ...

Getting Ready For 2018 Income Tax Filings

Self Employment, Tax Planning, Education Tax Credits, Education Tax Benefits, Tax Deductions

Tax records needed for 2018 returns Tax filing season kicks off in a few weeks. What records should you assemble? Due to recent tax law changes, you may not need all the records you've kept before. ...

Trading in a business car? Here are the new rules New tax legislation eliminated the tax deferral on exchanges of like-kind exchanges of property, except for real estate. This change (generally ...

After the new law repealed deductions for entertainment expenses, many businesspeople figure their write-offs for treating customers or clients to meals are gone for good. But interim guidance handed ...

Year End Business Tax Planning

Self Employment, Tax Planning, Starting a New Business, Tax Deductions

10 tax-savvy business moves to make before 2019 Even though 2019 is just around the corner, you still have time to take action and save on your business tax bill. Here are 10 ideas to consider:...