On April 24, 2020, President Trump signed the Paycheck Protection Program (PPP) and Health Care Enhancement Act into law. The act provides $320 billion in supplemental funding for the PPP and earmarks $60 billion to bolster the SBA’s Economic Injury Disaster Loan (EIDL) program.

Our team recently hosted a webinar to present an update on the PPP application and loan forgiveness process, the EIDL program, and tax updates associated with relief opportunities available under the CARES Act. If you are a small business owner or self-employed individual, i encourage you to review the material and contact our team with any questions about how to best implement these opportunities.

The full presentation that was reviewed during the webinar can be accessed by clicking the following link: COVID-19 Relief Opportunities: Updates for Employers & Self-Employed Individuals

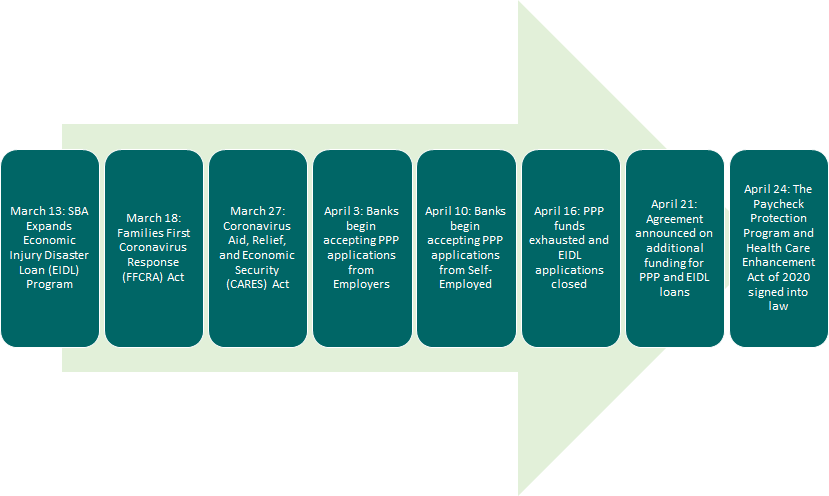

COVID-19 Relief Timeline

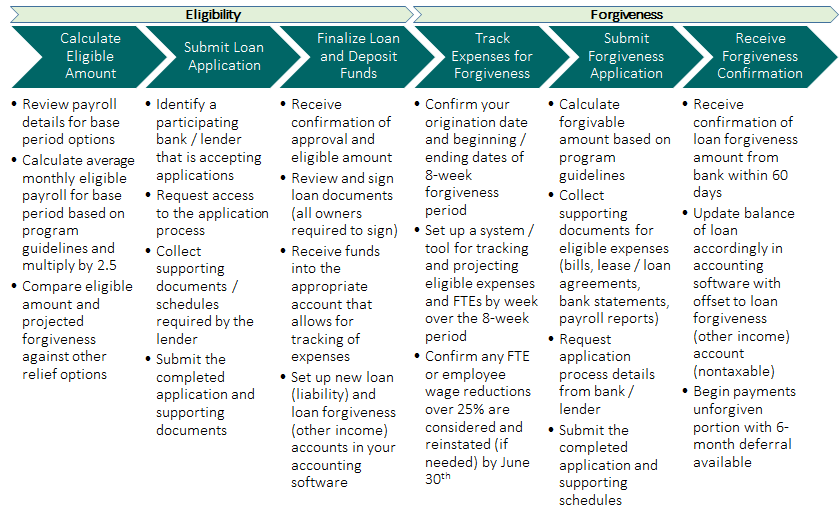

PPP Loan Application & Forgiveness Process

Our team will continue keep you updated on these opportunities and any new developments associated with relief efforts. If you have questions, be sure to reach out to us. We're here to help!