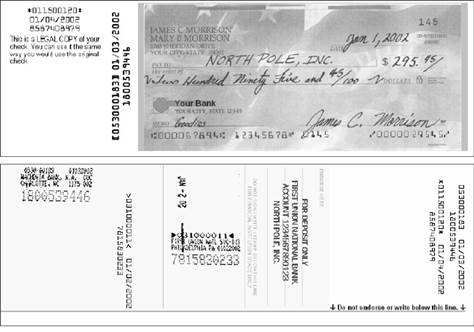

IRS Proof of Payment Requirements

Self Employment, Tax Planning, Tax Representation, Tax Deductions

Five Year End Tax Reminders

Retirement Savings, Tax Planning, Education Tax Benefits, Tax Deductions

Here are five tax saving ideas that can be used by most taxpayers. But act soon, there's not much time left until our tax year comes to an end....

Tax-Wise College Housing

Education Savings, Tax Planning, Education Tax Benefits, Tax Deductions

Does your child, grandchild, or someone else you know need a place to live while attending college? Instead of renting a dorm or apartment, buying a condo or small house might make more sense. This ...

When it comes to the perception of IRS audits, conjecture reigns supreme. The combination of the complex tax code and a government agency with the full authority to enforce it leads to some pretty ...

Despite what you may have heard from friends or family, you can still claim generous tax benefits for charitable contributions. Here are three prime examples of charitable tax breaks ripe for the ...

Cash in on summertime tax savings Summer is usually the time for relaxing, but it can also be a time for tax savings, especially if you're still reeling from an unexpectedly large tax bill in April. ...

Landlords: Review the new 199A safe harbor rule Owners of pass-through entities (S corporations, partnerships and limited liability companies) and sole proprietors can benefit from a new deduction ...